Anúncios

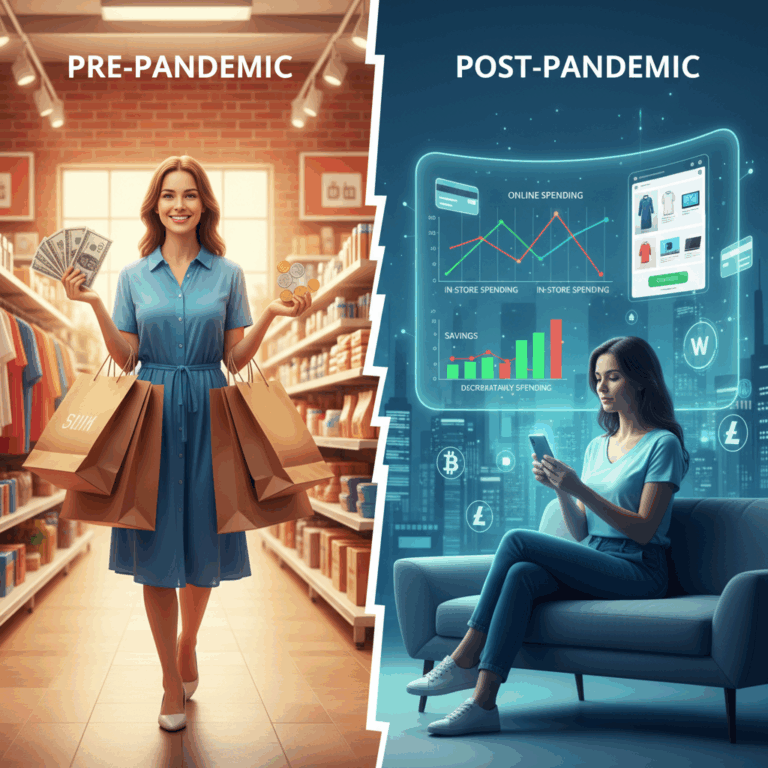

Changes in Spending Patterns After the Pandemic

The pandemic triggered profound shifts in consumer spending, transforming habits across service and retail sectors. Initially, spending on services dropped sharply as restrictions kept people home.

Meanwhile, retail spending, especially on groceries and home goods, surged. As life normalized, service spending rebounded strongly, signaling evolving consumer priorities.

Anúncios

Shifts in Service and Retail Spending

Spending on services like dining, travel, and entertainment collapsed during lockdowns but recovered to levels surpassing those before the pandemic by 2025.

Retail visits also changed, with more consumers seeking quality and value, leading to more cautious and deliberate purchasing decisions across categories.

Anúncios

Consumers increasingly favored experiences again while maintaining some new shopping habits formed during lockdowns, blending old and new spending behaviors.

Growth of E-commerce and Cross-Shopping

E-commerce remains a dominant force, with online shopping at near-pandemic peaks, reflecting a permanent shift in consumer preferences for convenience and variety.

Cross-shopping has increased, as consumers visit multiple retail formats like grocery stores and wholesale clubs to maximize value and choice.

This trend illustrates a more strategic approach to shopping, prioritizing both cost savings and product quality in a competitive market landscape.

Evolution of Saving Habits Post-Pandemic

The pandemic altered saving behaviors significantly, with many households increasing their savings due to fewer spending options and government aid. This build-up of savings provided a financial cushion during uncertain times.

As life gradually returned to normal, some consumers began using these savings, yet a cautious approach to spending remains, influenced by ongoing economic challenges and inflation concerns.

Impact of Reduced Spending and Stimulus

The reduction in spending opportunities during lockdowns led many to accumulate savings, supplemented by stimulus payments from governments. These factors together boosted overall household savings rates.

Stimulus funds helped support consumer liquidity, allowing many to maintain financial stability despite disruptions. This temporary cushion influenced spending and saving decisions well after restrictions eased.

However, the gradual return to normal spending patterns has seen some depletion of these reserves, as consumers address postponed purchases and everyday expenses.

Consumer Caution Amid Economic Uncertainty

Despite easing restrictions, uncertainty over inflation and economic stability has made many consumers more cautious with their finances. This caution affects both discretionary spending and saving strategies.

Consumers are prioritizing essential expenses and seeking value, often delaying large purchases or increasing their saving rate as a buffer against potential financial shocks.

This prudent approach reflects a shift toward long-term financial security rather than impulsive spending, highlighting changed priorities in the post-pandemic world.

Credit Delinquencies and Financial Management

Credit delinquencies have risen moderately since the pandemic, signaling growing financial pressure for some households. However, default rates remain relatively contained, indicating disciplined financial management overall.

Many consumers have adapted by focusing on budgeting and managing debts carefully, balancing spending needs with the goal of protecting their credit standing.

Interesting Insight

Financial institutions report increased engagement in debt counseling and flexible repayment options, helping consumers navigate challenges and avoid deeper credit issues.

Demographic Influences on Spending

Demographic groups significantly impact consumer spending, with varied preferences shaping market trends. Age, income, and values drive spending patterns today.

Younger generations like Millennials and Gen Z are influencing growth in discretionary spending while redefining priorities toward quality, value, and social responsibility.

Millennials and Gen Z Spending Trends

Millennials and Gen Z are now key consumers during their prime earning years, emphasizing experiences and technology-driven purchases. Their habits differ from older demographics.

Interestingly, while Millennials seek convenience and brand loyalty, Gen Z tends to be more deliberate, often reducing overall spending but expecting higher value for money.

Both groups prioritize digital engagement, using online platforms extensively, yet they balance this with an appetite for authentic, in-person interactions and discovery.

Value and Sustainability Demands from Younger Consumers

Today’s younger consumers demand that brands align with values such as sustainability, ethical sourcing, and social impact. This demand shapes product development and marketing.

They often scrutinize brand practices and prefer products offering long-term value, pushing companies to innovate and adopt transparent, responsible business models.

Interesting Insight

Studies show that nearly 70% of Gen Z shoppers choose brands committed to environmental or social causes, even if it means paying a premium for sustainability.

This shift increasingly forces retailers to prioritize eco-friendly practices and authentic messaging to capture and retain younger customers’ loyalty.

Long-Term Implications for Economy and Business

The lasting changes in consumer spending habits will continue to reshape markets, influencing how businesses approach sales strategies and customer engagement. Both digital and physical retail channels play crucial roles.

As consumers blend in-person and online shopping, companies must innovate to meet evolving preferences, emphasizing flexibility and personalized experiences to sustain growth in this hybrid landscape.

Blending In-Person and Digital Shopping

Consumers now expect seamless integration between digital platforms and physical stores, combining convenience with the tactile experience of shopping in person. This hybrid model is becoming standard.

Retailers are investing in omnichannel strategies that allow customers to browse online, buy in-store, or receive purchases via home delivery, enhancing satisfaction and loyalty.

The coexistence of these channels helps businesses capture diverse consumer needs, reflecting a permanent shift toward a more connected retail ecosystem evolving from pandemic-era behaviors.

Strategic Adjustments for Market Changes

Business strategies must adapt to heightened consumer focus on value, sustainability, and quality. This requires more targeted marketing and agile supply chains to meet diverse demands efficiently.

Companies are also leveraging data analytics to understand complex consumer behaviors and preferences, enabling personalized offers that build trust and competitive advantage over time.

Market Adaptation Insight

Successful brands are those incorporating sustainability initiatives and transparency, which resonate strongly with younger consumers prioritizing ethical consumption in their spending choices.

Long-term economic resilience depends on flexibility and innovation, as businesses navigate an environment shaped by cautious but discerning consumers seeking meaningful value.