Anúncios

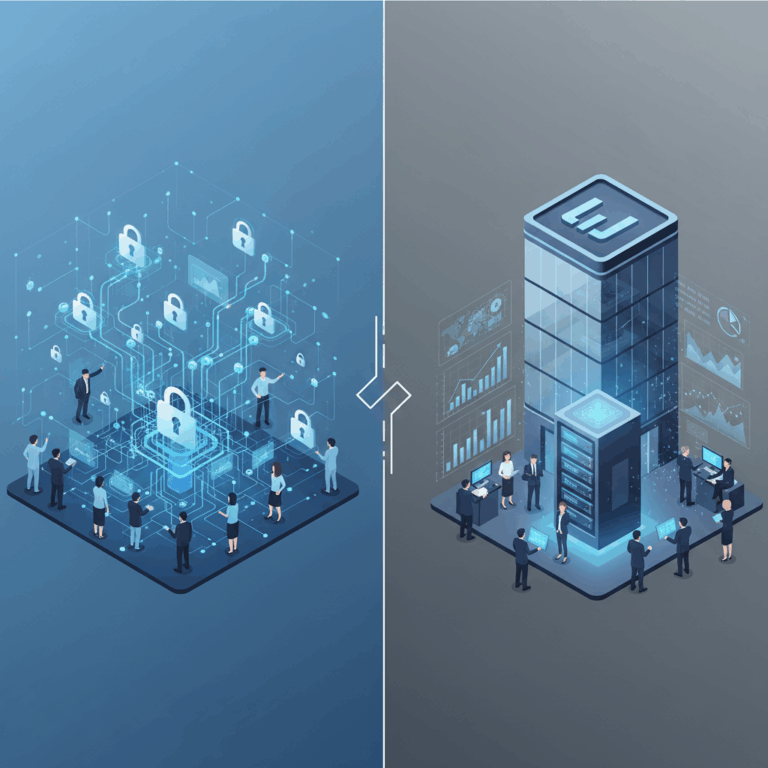

Overview of Centralized Exchanges (CEXs)

Centralized exchanges (CEXs) act as traditional brokerages where a central authority controls trading and holds custody of user funds. This model requires users to register accounts and often complete KYC verification.

CEXs offer a user-friendly experience and facilitate fast trades through off-chain order matching, making them ideal for both beginners and experienced traders.

Anúncios

Operational Model and Custody

CEXs operate by managing an internal order book and custodying user assets, meaning funds are held directly by the exchange. This central control simplifies transactions but introduces custodial risk.

The platform handles deposits, withdrawals, and order execution, maintaining liquidity and regulatory compliance, but users relinquish full control over their assets during use.

Anúncios

While this model improves speed and access, it creates potential security concerns, such as susceptibility to hacks and reliance on the exchange’s operational stability.

Key Features and User Experience

CEXs provide advanced trading features like margin trading, futures, and an extensive range of cryptocurrencies, enhancing the versatility available to traders.

Additionally, the platforms often include customer support and regulatory oversight, making them more approachable for new users entering the crypto space.

The high liquidity on centralized exchanges enables rapid order execution and better price stability compared to decentralized alternatives.

Overview of Decentralized Exchanges (DEXs)

Decentralized exchanges (DEXs) operate directly on blockchain networks without intermediaries, enabling peer-to-peer trading through smart contracts. This design allows users to maintain control over their funds at all times.

By eliminating custodianship, DEXs offer enhanced security and privacy, as users trade from their own wallets without the need to trust a central authority or disclose personal information.

Blockchain-based Operation and Fund Control

DEXs rely on smart contracts to automate trades and manage liquidity pools on-chain, ensuring transparent and trustless execution of orders without a centralized middleman.

Users retain ownership of their assets in non-custodial wallets, reducing counterparty risk and eliminating the need to deposit funds to the exchange itself.

However, transaction speed depends on the underlying blockchain network, and gas fees may apply, impacting cost and timing compared to off-chain order books.

Privacy and Security Advantages

DEXs offer superior privacy since they typically require no personal data or KYC, allowing anonymous and permissionless trading globally.

Security risks linked to centralized fund custody are removed, as users retain control, reducing exposure to large-scale hacks common in CEXs.

Smart contracts provide transparency, enabling users to verify the platform’s code and operations, fostering trust through openness rather than central authority.

Limitations and Technical Challenges

Despite benefits, DEXs face variable liquidity, which can lead to higher slippage and less stable prices during large trades or low activity periods.

The user interface is often less intuitive, demanding greater technical knowledge and understanding of wallet management from traders.

Smart contract vulnerabilities present risks such as bugs or exploits, and slower on-chain processing can delay trade execution compared to centralized systems.

Interesting Fact

Some DEXs use automated market maker (AMM) models, where liquidity providers earn fees by supplying tokens, innovating how decentralized liquidity is generated and maintained.

Comparing Pros and Cons

Advantages of CEXs

Centralized exchanges offer high liquidity and fast transaction speeds, enabling efficient and seamless trading experiences for users of all levels.

The platforms provide advanced trading features such as margin trading and futures, catering to more experienced traders seeking diverse options.

Additionally, CEXs offer customer support and regulatory compliance, making them more approachable and trustworthy for many users worldwide.

Advantages of DEXs

DEXs enhance security by allowing users to maintain custody of their assets, reducing risks related to centralized hacks and theft.

They offer greater privacy through permissionless access, requiring no KYC or personal data, which appeals to users valuing anonymity.

Decentralized exchanges provide transparency via public smart contracts and resist censorship, ensuring open and unbiased trading environments.

Risks and Drawbacks for Both

CEXs carry risks of fund loss due to hacks or operational failures since users entrust assets to a central custodian vulnerable to attacks.

DEXs face challenges like lower liquidity, slower transaction times, and potential smart contract bugs that can lead to lost funds or trading inefficiencies.

Both types have trade-offs in usability, security, and regulation; choosing depends on individual priorities regarding control, convenience, and risk tolerance.

Choosing Between DEX and CEX

Selecting between a DEX and a CEX depends largely on individual user needs and priorities such as control, privacy, and ease of use. Each platform serves distinct trader preferences.

Users valuing convenience and quick access often prefer CEXs, while those prioritizing fund control and privacy tend to lean towards DEXs because of their non-custodial nature.

User Needs and Priorities

For users seeking simple, fast transactions with high liquidity and advanced trading options, CEXs typically provide a more satisfying experience.

Alternatively, users who emphasize privacy, security, and decentralization might find DEXs more appealing despite their technical complexity and variable liquidity.

Regulatory compliance and customer support are crucial for beginners or institutional traders, aligning more closely with CEX offerings.

Ultimately, assessing priorities like custody control, anonymity, fees, and trading features guides the right choice between the two platforms.

Suitability for Different Trader Profiles

Novice traders often benefit from CEXs due to intuitive interfaces, comprehensive support, and faster trades, facilitating smoother entry into crypto markets.

Experienced or privacy-conscious traders might prefer DEXs to maintain asset control, avoid KYC, and engage with the decentralized ecosystem directly.

Day traders or those requiring margin and futures trading find CEXs more suitable, given their liquidity and product variety.

Conversely, long-term holders valuing censorship resistance and non-custodial control may lean towards DEX platforms despite slower speed and less liquidity.